The once-booming short-term rental market in Joshua Tree has significantly cooled, reflecting broader shifts in the post-pandemic travel landscape. Property owners who invested heavily during the peak of remote work and desert getaway trends are now facing reduced occupancy rates and diminishing returns. The transformation has left a complex economic imprint on the small desert community, altering local housing dynamics and challenging previous assumptions about tourism-driven growth.

The Desert Rental Revolution

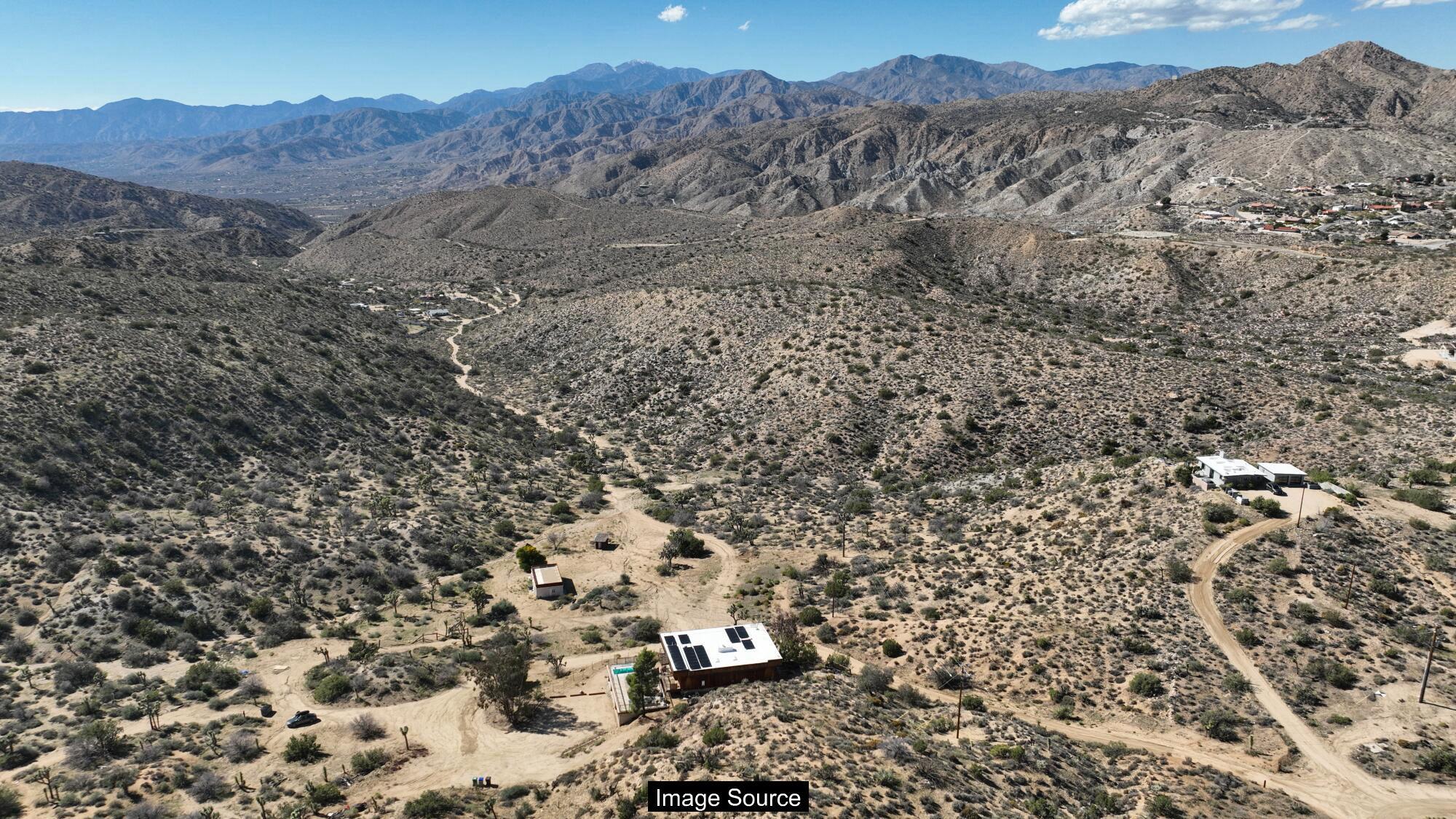

During the COVID-19 pandemic, Joshua Tree transformed from a sleepy high desert community into a vibrant vacation rental destination. Investors and remote workers saw an opportunity to escape urban centers, purchasing properties with dreams of generating substantial rental income. The region experienced a dramatic real estate boom, with home values skyrocketing and short-term rental listings proliferating across the landscape.

Software engineer Emmanuel Ruggiero exemplified this trend, constructing a modern cabin complete with luxurious amenities like a swim spa and private nine-hole golf course. His property represented the archetypal pandemic-era investment: a carefully designed retreat meant to capitalize on the surge in remote travel and isolation-seeking tourists. However, the reality of managing such a property proved more complex than anticipated.

The Joshua Tree area saw unprecedented growth in short-term rental listings, peaking at 3,606 properties during the pandemic’s height. Investors from Los Angeles and Orange County aggressively purchased and renovated desert properties, transforming quiet neighborhoods with lavish, Instagram-worthy accommodations featuring amenities like bocce ball courts, outdoor fire pits, and even private lazy rivers.

Market Dynamics and Investor Challenges

The short-term rental market in Joshua Tree began experiencing significant shifts by 2025. Listings declined to 3,449, signaling a potential market correction. Investors like Ruggiero found themselves struggling to maintain profitability, with some properties selling at substantial losses compared to their peak valuations.

Several factors contributed to this downturn. The post-pandemic economic landscape introduced new challenges: companies recalled employees to offices, international travel resumed, and household finances became strained by inflation. These changes dramatically reduced the appeal of remote desert rentals.

Experienced investors with existing capital and management infrastructure fared better than individual homeowners. They leveraged economies of scale, established relationships with cleaning services, and could absorb initial investment costs more effectively. However, even these sophisticated operators began reassessing their desert property strategies.

Community Transformation

Longtime residents like Gina Grandi witnessed profound changes in the local landscape. What were once modest ranch properties became sites of multimillion-dollar mansions, dramatically altering neighborhood character. The influx of short-term rentals disrupted long-standing community dynamics.

Rental properties transformed quiet neighborhoods, introducing weekend party crowds and reducing long-term housing availability. Some landlords evicted existing tenants to pursue more lucrative short-term rental opportunities, further straining local housing markets.

The aesthetic of the region shifted dramatically, with ultra-contemporary black-painted homes featuring luxurious amenities rising among traditional desert dwellings. This architectural transformation reflected the broader economic and cultural changes sweeping through the area.

Investor Perspectives

Real estate investor Patryk Swietek, who manages approximately 120 short-term rentals in the area, observed nuanced market shifts. Properties in less scenic neighborhoods that previously booked solid during the pandemic now struggled to attract guests. The initial appeal of space and seclusion began to wane.

Investors like Gita Vasseghi discovered unexpected challenges. Initial excitement about low interest rates and successful rental models gave way to practical difficulties: renovation complications, contractor issues, and rapidly changing market conditions. What seemed like a guaranteed investment strategy proved far more precarious.

Many investors discovered that the anticipated financial returns did not materialize. As one investor candidly noted, the dream of becoming an ‘Airbnb millionaire’ during COVID proved more fantasy than reality for many.

Common Questions About Desert Rentals

Potential investors and curious observers often have specific questions about the Joshua Tree short-term rental market. Understanding the current landscape requires examining both the opportunities and challenges that have emerged in recent years.

Q1. Why are short-term rental listings declining in Joshua Tree?

A1. Multiple factors contribute, including post-pandemic travel shifts, economic uncertainty, increased operational costs, and reduced tourism demand. Investors are finding the market less profitable than during the pandemic’s peak.

Q2. Are all short-term rental investments failing in the area?

A2. Not universally. Experienced investors with sophisticated management strategies and properties offering unique experiences continue to find success. However, individual homeowners and less strategic investors face more significant challenges.

Strategic Pointers

The Joshua Tree short-term rental market demonstrates the importance of adaptability and thorough market research. Investors must carefully evaluate economic trends, local regulations, and sustainable operational strategies before committing significant resources.

Successful desert property investments now require a more nuanced approach. This includes understanding local community dynamics, maintaining properties with genuine appeal, and developing flexible rental strategies that can withstand economic fluctuations.

While the pandemic-era gold rush has subsided, opportunities remain for strategic investors who can navigate the evolving landscape. The key lies in understanding local market dynamics, maintaining high-quality properties, and remaining responsive to changing traveler preferences.

※ This article summarizes publicly available reporting and is provided for general information only. It is not legal, medical, or investment advice. Please consult a qualified professional for decisions.

Source: latimes.com